Spotlight

DISCOVER OUR TWO-GENERATION EVALUATIONS

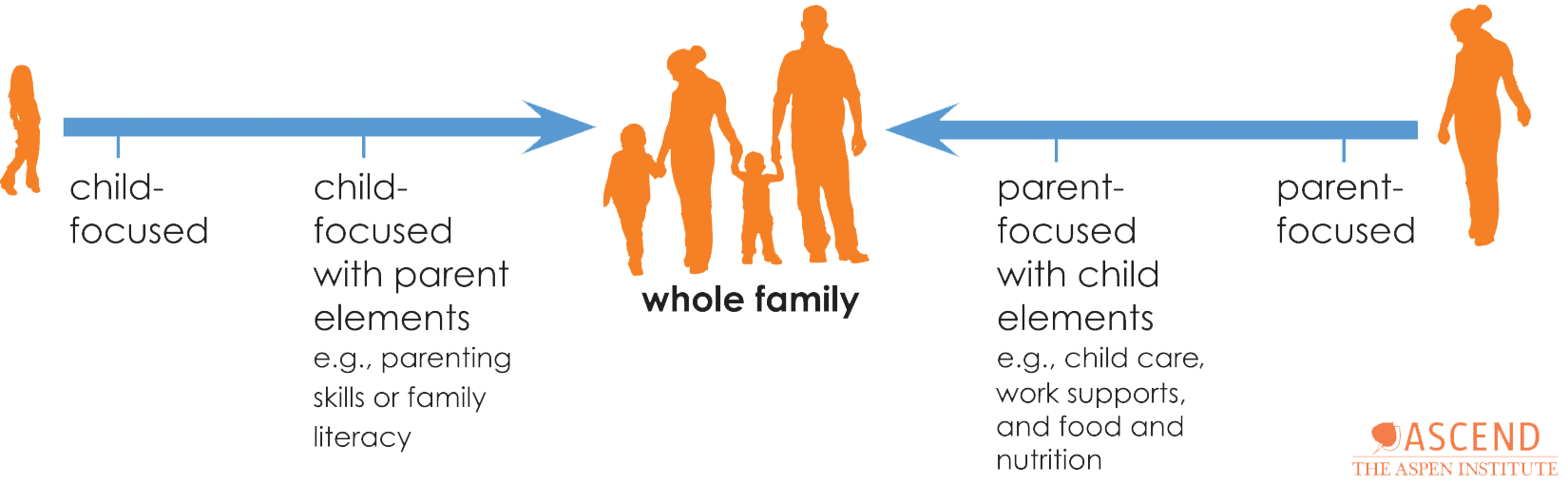

Two-Generation programs explicitly target low-income parents and children from the same family, providing intensive, high-quality services for both, achieving greater results than the sum of its parts