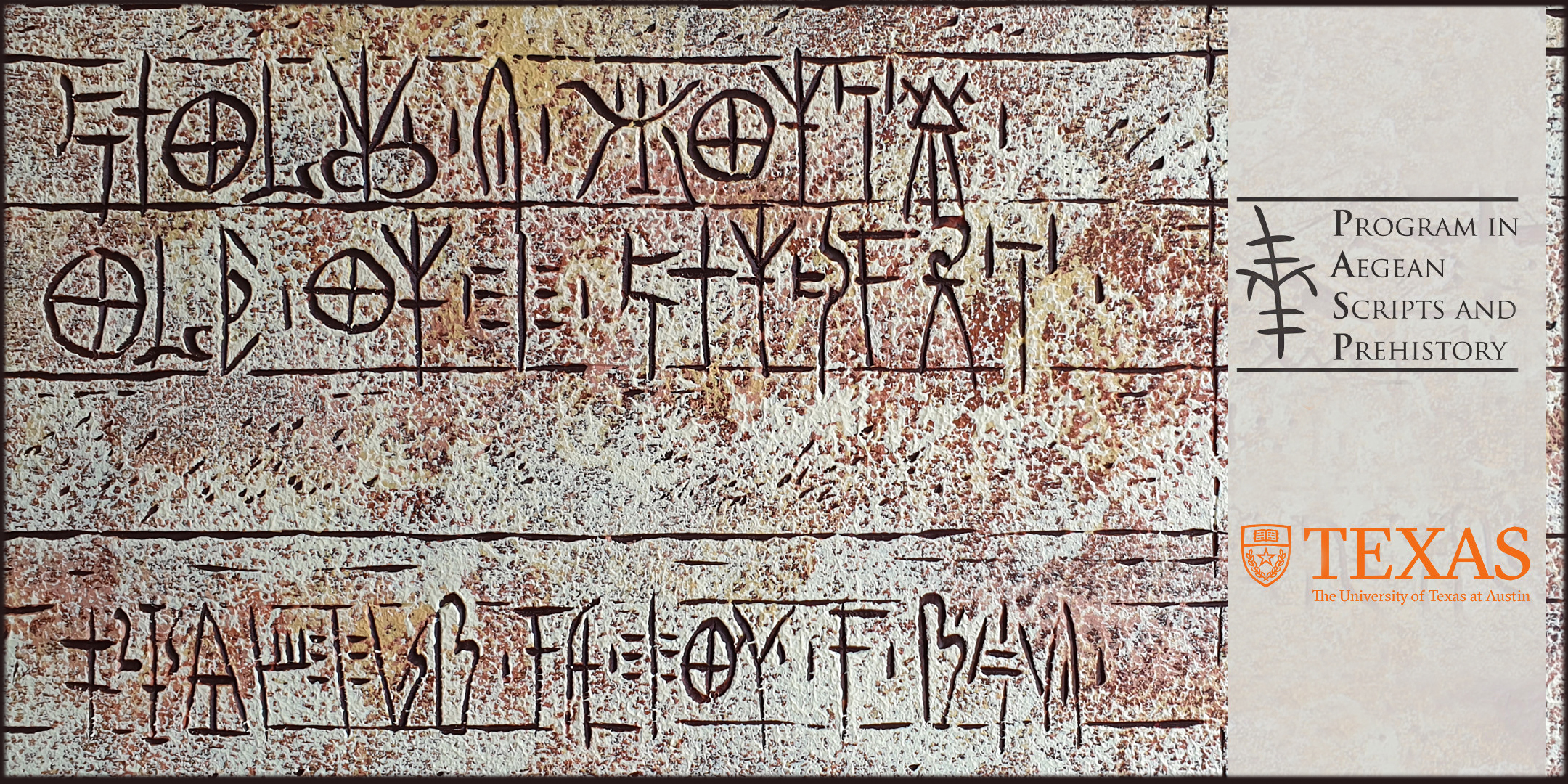

Welcome to the PASP website.

Here you will find:

- Updates on PASP’s latest projects

- Visit reports written by scholars and artists on their work with PASP and its materials

- Information on our archival collections and the people who contributed to them

- Links to thousands of items of our archival materials hosted at Texas ScholarWorks.

- Links to hundreds of published articles spanning decades on Aegean scripts by PASP fellows

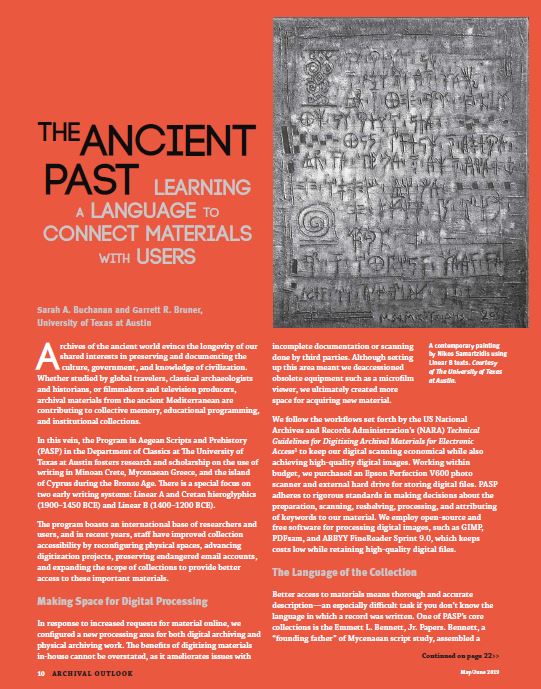

- A summary of the archives work done at PASP in the May/June 2019 issue of Archival Outlook in the article The Ancient Past: Learning a Language to Connect Materials with Users.

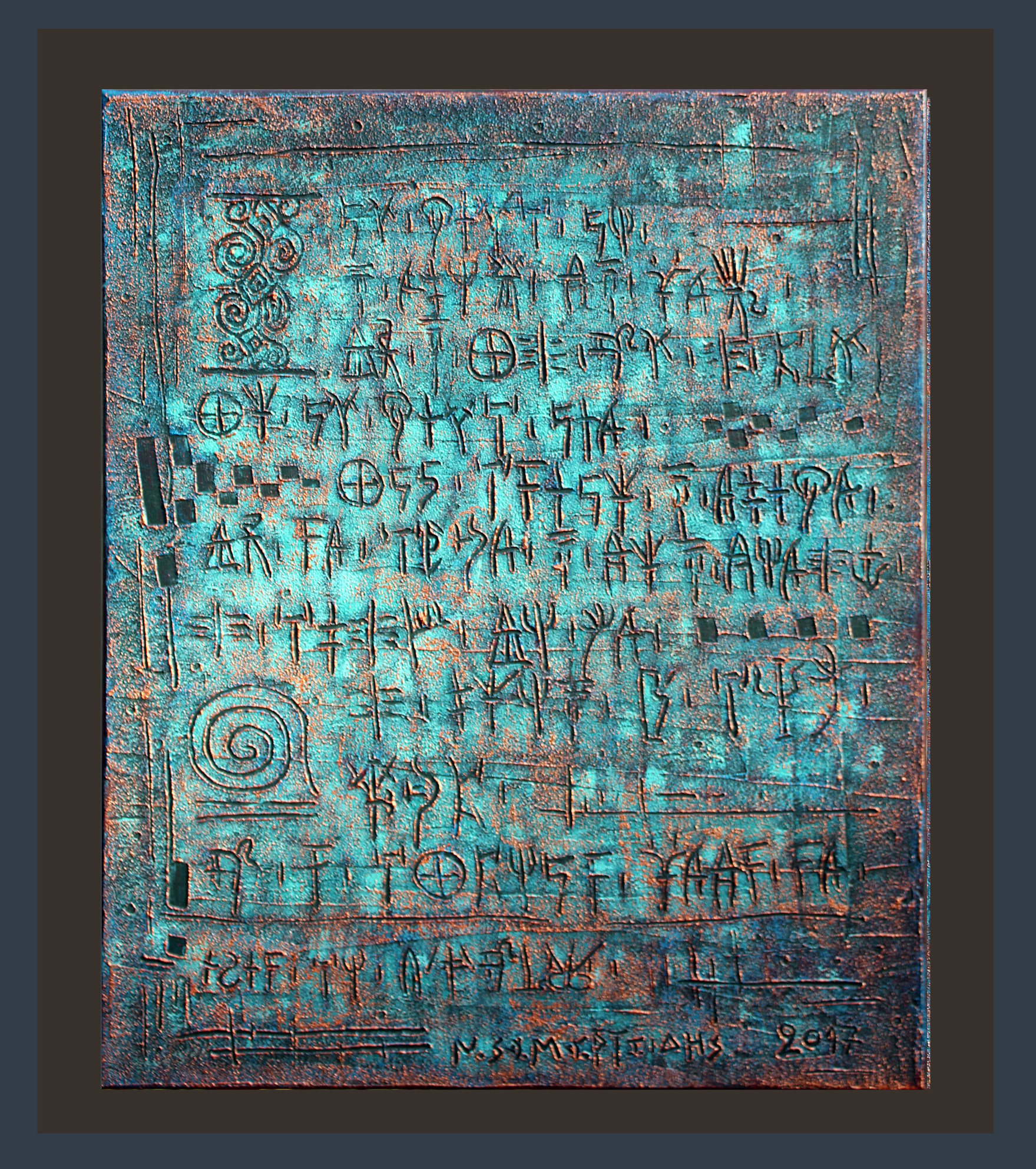

From the imaging and publication of the Pylos tablets, to our new annual research program focusing on script use throughout the world, to our proposal to expand PASP into a larger research center for the study of scripts and decipherment, we are moving in new directions and will be keeping you informed on all of them.

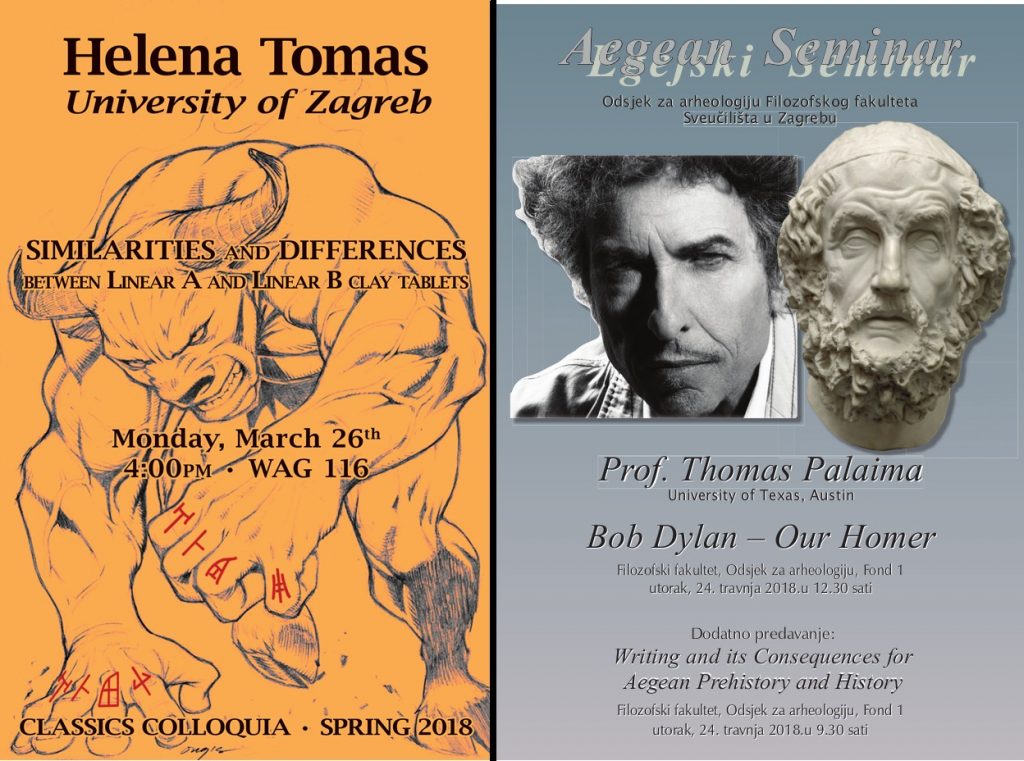

Tom Palaima’s scholarship and public intellectual work pertaining to war and violence and to Dylanology can be found at his homepage. Also included there are links to over three hundred Editorials and Featured Articles authored for publications like the Times Higher Education and Austin American-Statesman.

Get to know PASP taking a video tour with our director, Tom Palaima

PASP News and Project Updates

January 15, 2024

AIA Paper 2024, Ciphers, The Grid, Transfer of PASP Archives to University of Cincinnati, and More

AIA CHICAGO 8B: Writing in the Bronze Age.

Held on January 7, 2024

Tom Palaima “Chairs and Stools and their Status Implications in the Pylos Ta ‘Totenmahl’ Inventory”

INTRODUCTION:

Tom Palaima says he is someone who has been lucky to work literally for 50 years now on Linear B, for forty-nine years off and on on the Ta series alone.

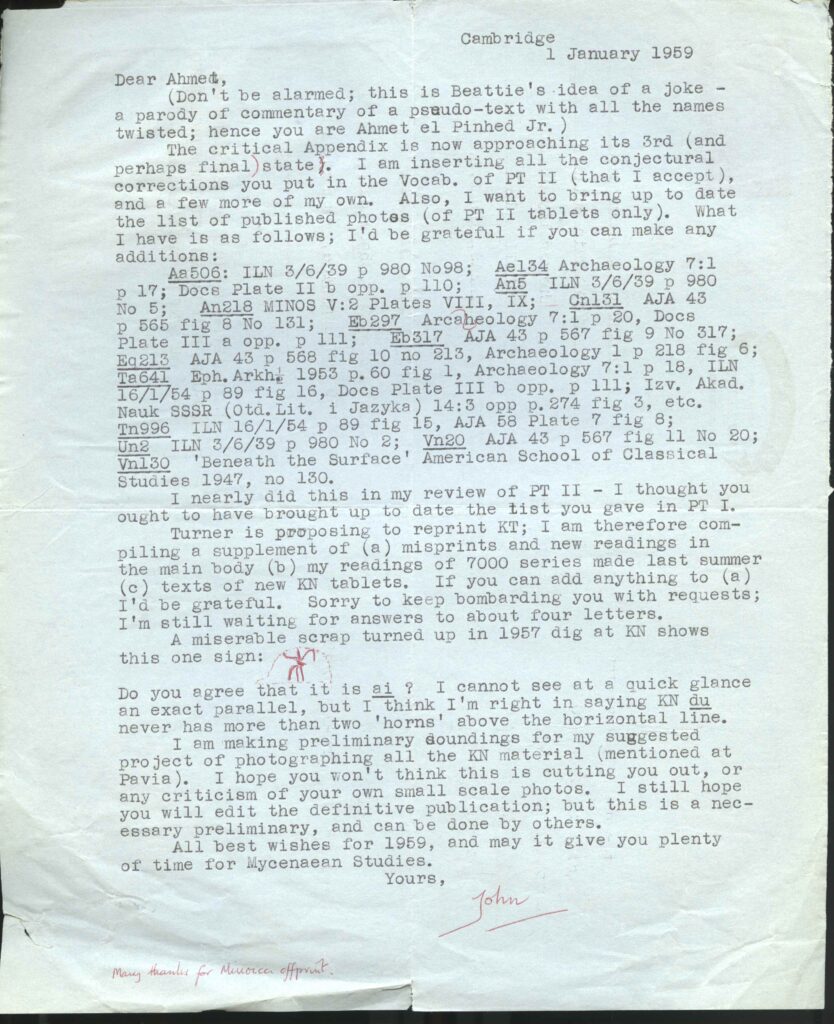

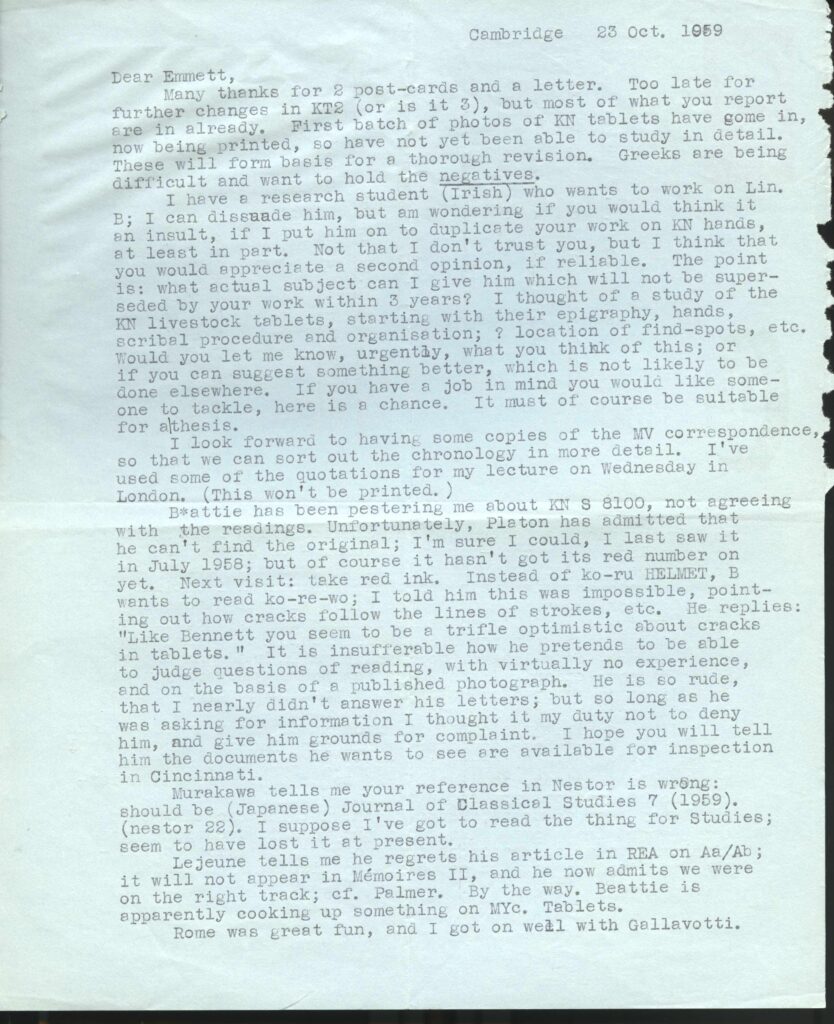

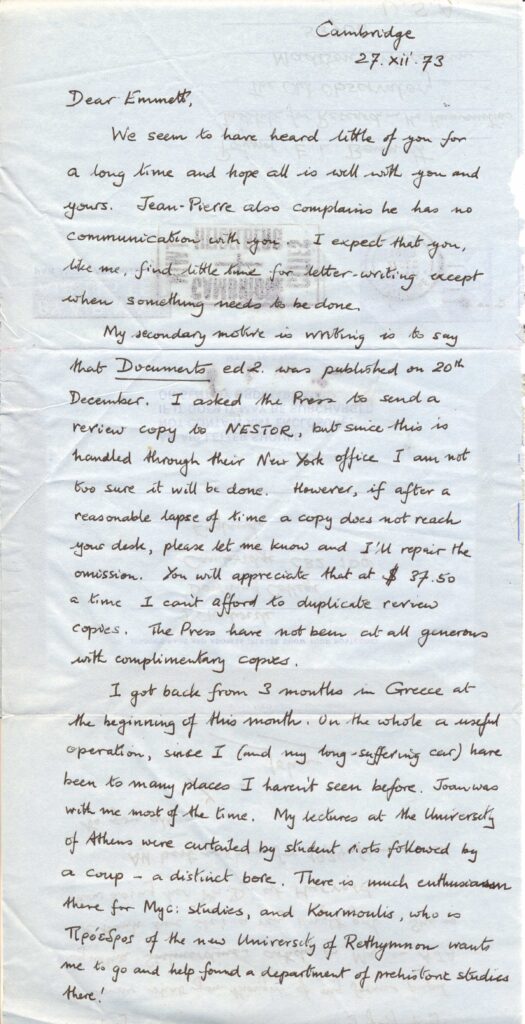

For the first thirty-seven years, he worked at first under and quickly alongside a kind, supportive, honest, music-loving, accepting, quietly playful and truly gentle man, Emmett L. Bennett, Jr, recipient of the AIA gold medal in 2001, who passed away twelve years ago on December 15, 2011.

Emmett became a trusted friend to Tom and, eventually, in his last five years, with Alzheimer’s, a twelve-year-old boy who loved ice cream and music, two lifelong passions. The many times Tom arrived at Emmett’s final place of care in Madison, and his daughter Cynthia would ask Emmett “Who’s that?”, Emmett would answer, “He’s my friend.” That is, Tom says, the greatest honor of his life.

Tom reports that the process is well underway, as some of you know, of transferring from PASP at UT Austin the papers, research notes, photographs, manuscripts, and typescripts, and letters of Alice E. Kober, Emmett L. Bennett, Jr., Michael Ventris, William Brice, Elizabeth Barber and other related scholars (like John Franklin Daniel and Tom’s own extensive research papers) to their permanent home in the archives of the Department of Classics University of Cincinnati. There they will merge with the archives of Bennett’s revered mentor Carl Blegen.

He wants to thank publicly Garrett Bruner, PASP-INSTAP archivist at UT, Jeff Kramer, archivist at UC, Jack Davis, Kathleen Lynch, Daniel Markovich and the entire Classics program at UC for making sure that these valuable materials will be preserved and available for future scholars. He also thanks INSTAP and UT Austin for many, many years of support.

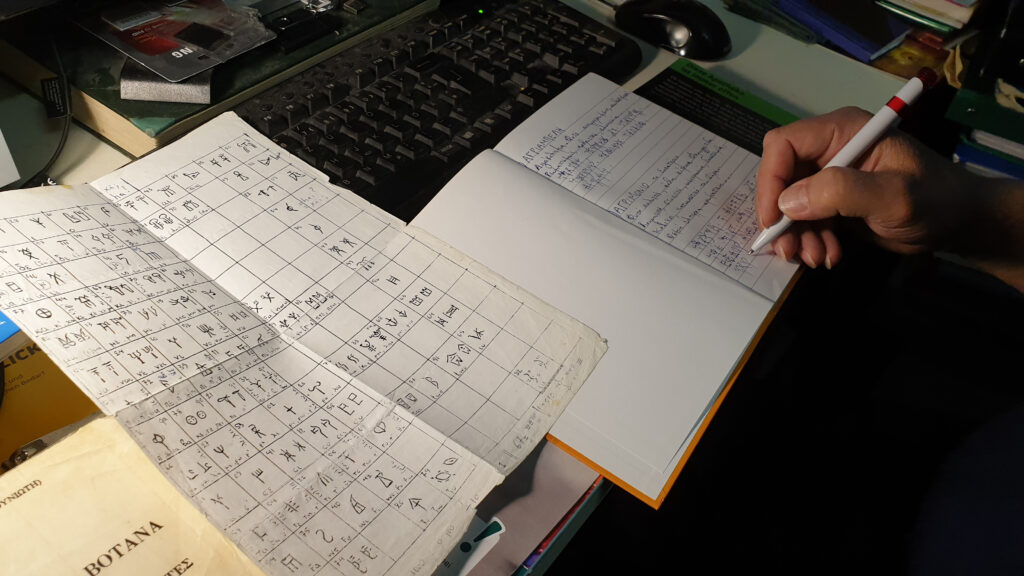

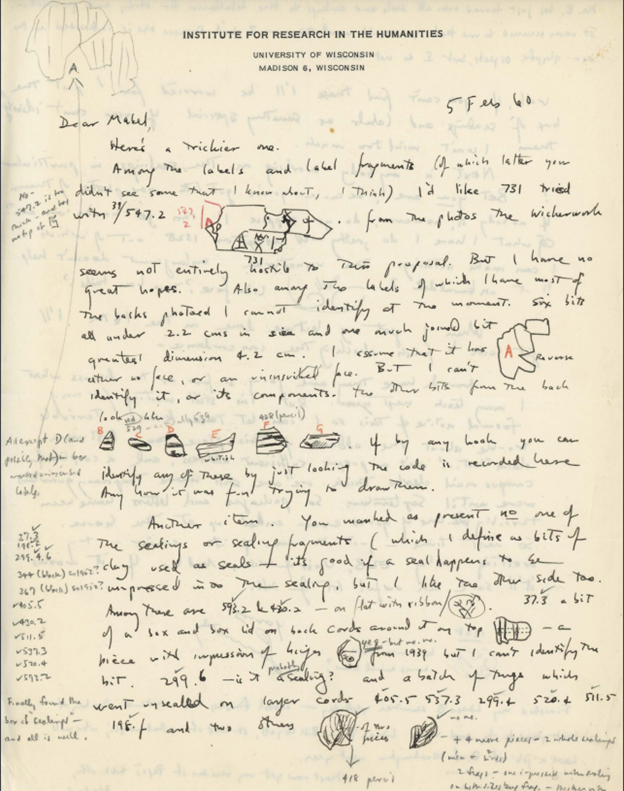

There is much work to do still with these archives—Brent Davis and Anthony Bronzo just this past year in the last eight months made a brilliant breakthrough in how the over 200,000 cigarette carton notecards relate to Kober’s Brooklyn College notebooks and how transferring the data analytically from one to the other led to her discovery of the sign groups appearing as triples, which we now know, as Ventris ascertained, are Cretan place names and their masculine and feminine adjectival forms. Using the PASP archives has produced, since Margalit Fox’s sensational book on Kober’s work, The Riddle of the Labyrinth (2013), the following:

Ciphers – An Opera (2023)

by Bernadine Corrigan

‘Ciphers’ tells the true story of two brilliant and complex people, Michael Ventris and Alice Kober, and their quest to decipher the ancient script known as Linear B. It is a story of clashing personalities, thwarted ambition, success and tragedy. The opera uses dramatic reconstruction, comedy and mythical fantasy to reveal the fascinating lives of two extraordinary people.’

Music by Greg Arrowsmith

Libretto by Bernadine Corrigan

Cast

Michael Ventris – Henry Ross (voice); Simon Stallard

Alice Kober – Katharine Taylor-Jones

Theseus – Benjamin Noble

Ariadne – Alice Johnston

Sir John Myres – Graeme Danby

Michael’s Mother – Camilla Jeppeson

Directed by – Elaine Tyler Hall

Director of Photography – Bjorn Ventris

Camera Operator – George Petais

Edited by – Bjorn Ventris

Sound Engineer – Anthony Galatis

Costume – Hannah Heaf

Producers – Bernadine Corrigan & Patrick Thompson

Deciphering the Silence: A Literary Journey to Alice E. Kober

By Regina Dürig

In the autumn of 2017, Regina Dürig visited PASP to complete her dissertation, Deciphering the Silence: A Literary Journey to Alice E. Kober. In it, she explored Kober’s life in creative ways, taking a literary journey with her in order to start ‘deciphering the silence’.

For the PASP website, she authored a piece about her visit to Austin, Texas, and her work at PASP.

More about Regina’s research and other works can be found at this interview with the Swiss Consulate of New York.

The Grid

by Eli Payne Mandel

The American edition of Eli Mandel’s brilliant tri-sequenced 92-page narrative poem, The Grid, has just appeared. It focuses for its first forty-seven pages on Kober’s life and work.

Released by the UK based press Carcanet in late 2023, The Grid was named The Telegraph’s Poetry Book of the month August 2023. From the publisher’s website, The Grid‘s abstract reads:

“The Grid is about the end of worlds, ancient and modern. In three sequences of poems interspersed with Mandel’s own translations from classical texts, figures of obsession and loneliness try to decrypt what Maurice Blanchot called ‘the writing of the disaster’. Like a detective novel, the title sequence pieces together archival fragments into a lyric essay about Alice Kober, the half-forgotten scholar behind the decipherment of the ancient writing system called Linear B. Across different wartimes, Mandel adapts the typography and formatting of archived papers, their overlaps and errors and aporias, which compel readers to invest creatively in the very act of reading, learning new ways into language as they go.”

“I Pity the Poor Immigrant: Celebrating the Gradually Un-forgotten Life and Work of Alice Elizabeth Kober”

May 21/22, 2023 National Archaeology Week 2023 at Macquarie University, Australia

Tom Palaima delivered an opening Key-Note Lecture in connection with the exhibition Mysteries Revisited: From Ancient Codes to Comic Culture. The exhibition featured original research materials of Alice Kober from the PASP archives.

Updated on January 15, 2024 by Garrett R. Bruner. garrettbruner@utexas.edu

October 6, 2023

I Pity the Poor Immigrant: Celebrating the Gradually Un-forgotten Life and Work of Alice Kober

On May 23, 2023, Tom Palaima, University of Texas at Austin Robert M. Armstrong Centennial Professor and Director, Program in Aegean Scripts and Prehistory (PASP), presented on Zoom this key-note opening lecture for the National Archaeology Week 2023 at Macquarie University, Australia, in connection with their exhibition Mysteries Revisited: From Ancient Codes to Comic Culture, which featured original research materials of Alice Kober from the PASP archives.

Archival materials from PASP were shipped to the continent of Australia in August 2022 to become centerpieces of the exhibition at the Macquarie University History Museum exhibition: Mysteries Revisited! From Ancient Codes to Comic Culture. 26 September 2022 – 31 March 2023. More information about this exhibition can be found at https://www.mq.edu.au/faculty-of-arts… . The show was extended through the summer by popular demand.

Palaima gave a Zoom lecture on May 21, kicking off national archaeology week in the land down under. He highlighted what the materials on loan reveal about how researchers attacked the problems of deciphering three related scripts and the as yet unidentified languages they represented as ‘visible speech’.

He also marked out the recent discovery made in April 2023 by Melbourne University Professor Brent Davis and UT graduate student Anthony Bronzo regarding how Kober’s voluminous work notes relate to her dense and detailed notebooks.

Updated on October 6, 2023 by Garrett R. Bruner. garrettbruner@utexas.edu

March 24, 2023

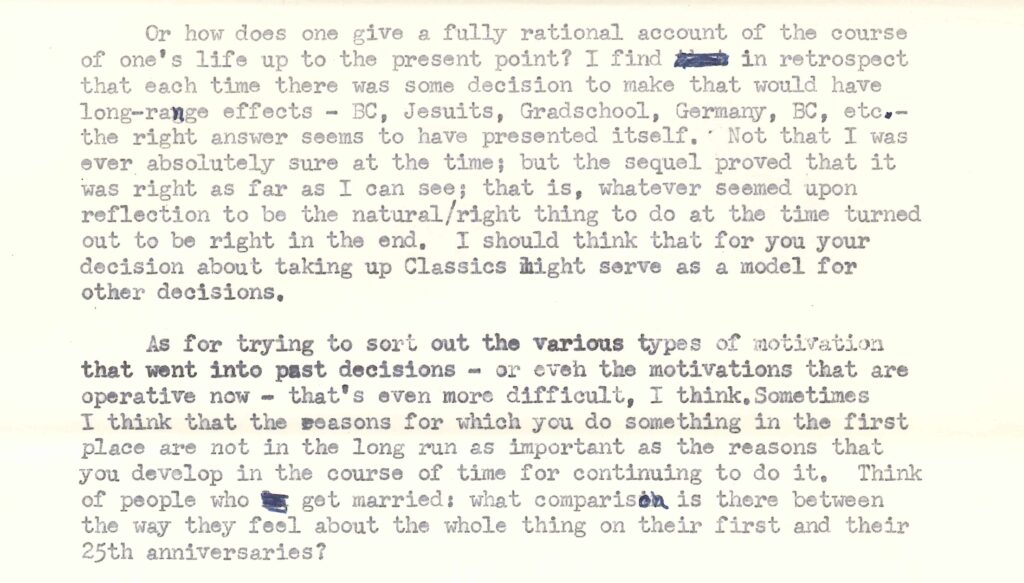

Reminiscences on Mentors

by Tom Palaima

Robert M. Armstrong Centennial Professor of Classics

Director, Program in Aegean Scripts and Prehistory

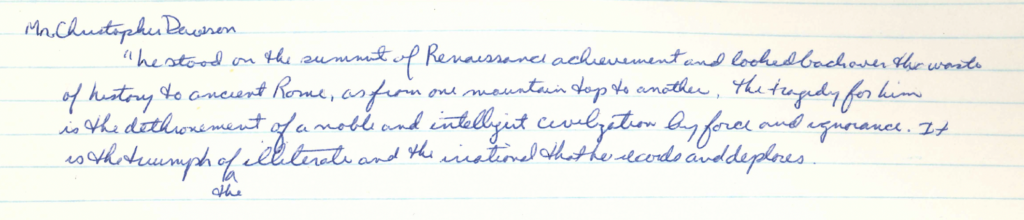

Ten years ago I wrote a feature piece for the Times Higher Education on mentors as a kind of endangered species (see PDF version here). In thinking back now on the nearly fifty years since I took my first graduate class in Classics, I think of two academic ‘men of God’ who deeply affected my outlook on life.

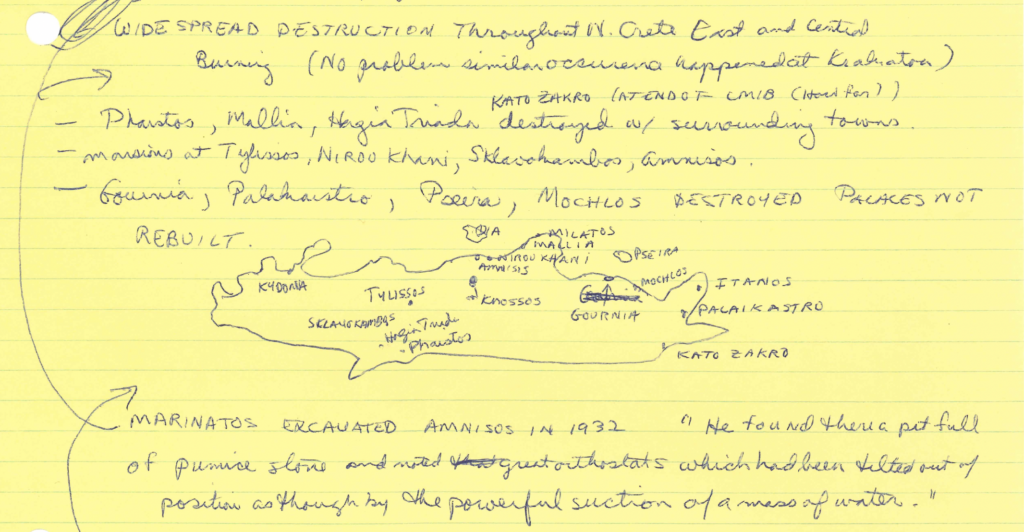

The first was my main ugrad mentor at Boston College (1969-73) and the teacher who introduced me to the Greek Bronze Age. David Gill, S.J. had studied at Harvard, completing his Ph.D. under Sterling Dow on Greek Cult Tables. Dow, mainly a classical epigrapher and historian, had developed an interest in what were then called Minoan inscriptions after the Ventris decipherment of the Linear B script in June 1952. As a consequence, Gill’s two-semester ancient Greek history course spent many weeks on Aegean prehistory, during which I reported on what then was early scientific research on the volcanic eruption of Thera. Actually, I contracted mononucleosis that semester and by the time I recovered, Gill suggested that instead of writing up a report, I deliver a whole class lecture on the readings I had done. I agreed at first, thinking that this would be easier. Then I realized I had to present a 50-minute lecture to an audience of about 65 students, most of whom I did not know. I was so terrified I memorized the entire talk. How I avoided a relapse into exhaustion illness I do not know.

In Gill’s class we also read William McDonald’s inspiring classic Progress into the Past (1967). Right now I am using it in AHC 378 History of Greek Prehistory. Another example of Gill’s ingenuity with regard to making up course work now comes to mind. In spring of my freshman year (1970), we missed many weeks because of the general student strike sparked in part by government lies about the bombing of Cambodia. In order to make up for those missed weeks over the summer, Gill set me to translate large parts of Vergil’s Aeneid. I have my doggerel English poetic version somewhere in notebooks.

Looking back now over a half century, what was most special about Fr. Gill was that, like Fr. Tom Bermingham who was later a revered colleague of mine at Fordham University (1980-86), Gill had internalized Matthew 5-7. This part of the gospel of St. Matthew contains the Sermon on the Mount, the Beatitudes and the Lord’s Prayer. But it also contains prescriptions, straight from the mouth of Jesus and yet nowadays forgotten or ignored, about how to conduct yourself when doing good unto others, including even making charitable donations. In strict accordance with Jesus’s advice, neither David nor Tom ever drew attention to their active commitment to the poor, the needy and the forgotten in our society. Their behavior is consistent with a behavior of that all but extinct species in our age of hyper-capitalism. I refer to the anonymous donor. Here is what Jesus says in Matthew 6: 1-4:

Be careful not to practice your righteousness in front of others to be seen by them. If you do, you will have no reward from your Father in heaven.

2 “So when you give to the needy, do not announce it with trumpets, as the hypocrites do in the synagogues and on the streets, to be honored by others. Truly I tell you, they have received their reward in full. 3 But when you give to the needy, do not let your left hand know what your right hand is doing, 4 so that your giving may be in secret. Then your Father, who sees what is done in secret, will reward you.

In the classroom and in the great tutorial seminars he conducted for us, Gill was focused on scholarly matters. In my senior year, Gill and four of us students read through Grote’s History of Greece during the fall semester and Gibbon’s Decline and Fall of the Roman Empire in the spring semester. We met weekly on Wednesday evenings for dinner at the Jesuit house and then two hours afterwards of discussion of the reading at hand. This was the first time I became aware that one could “be an intellectual” in the normal course of life and not just in the classroom: at the dinner table or afterwards over sherry or for that matter anywhere at all.

Eight years later while teaching at Fordham University, I got to know Tom Bermingham, S.J. Bermingham had become famous for his scenes in the movie The Exorcist where he played a role as president of Georgetown University offering advice to Father Damien Karras, the young priest who has to grapple with the demon possessing the young girl Regan MacNeil while himself having a crisis of faith. Bermingham was also expert on the subject of exorcisms and had served as a mentor to fabled—in my mind now infamous—Penn State University football coach Joe Paterno. What is remarkable about Bermingham, too, is that he would fit in teaching a course on Homer with his holy work of settling newly arrived Cambodian refugees in ‘bad’ neighborhoods in the South Bronx and shepherding them in their adjustment to American culture. Their adjustment was almost always successful because of Tom Bermingham’s ingenuity and indefatigable work as ‘good shepherd’ on their behalf. None of that work gets in Bermingham’s extensive Wikipedia profile. Like Gill’s work, it was done “off the record.”

This poem by Father Gill I think speaks well to the souls of both of these remarkable human beings whom I am very glad to have known in my early days. I am sure they reinforced my inclination to work at different times with veterans, with poverty-level adults trying to go back to school, with youths and parents confronting violence and to devote so much time to addressing educational and political problems and general social norms and values in my twenty years of serious public intellectual writing. I can still feel the invitingly conspiratorial way Tom Bermingham would talk, while dragging on a cigarette, about his movie work and about Homer, and on rare occasions about his refugees, their hardships and successes. “Did you ever consider this, T?” I can still hear Dave Gill’s clear and comforting voice, offering advice by posing questions that I would take away and think about. Both men left with me a residue of goodness that has always warmed me and provided a flickering light “in the dark and cloudy day.” They are proof to me of Viktor Frankl’s contention that happiness, in our modern sense, cannot be pursued, but is itself the rare residue of working hard to do good in and of itself.

David Gill, S.J.: In My Own Words. 1992

https://epublications.marquette.edu/conversations/vol2/iss1/14/

“ I’m a Jesuit in the university,

a teacher, a scholar, a humanist

trying to study and teach history

from the point of view of the losers

rather than the winners,

the poor rather than the rich,

the peasants rather than the princes.

I think the modern Jesuit, and Christian,

is challenged to take a leap of faith

and believe that God is to be found

not only in the beauties of the divine

and human creation but also in the lives

and sufferings of the poor and outcast

members of the human race.

As a teacher, as a scholar in the humanities,

and as a Jesuit, I pursue an understanding

of what Dostoyevsky’s Father Zossima calls

‘active love’ – severe and terrifying,

entailing hard work and tenacity,

but close to ‘the miraculous power of the Lord.’ ”

David Gill SJ Lecturer in Classics

Then Rector of the Jesuit Community College of the Holy Cross

Now retired

For more of Tom Palaima’s story, both professional and personal, visit his recently updated faculty profile page.

Updated on March 24, 2023 by Garrett R. Bruner. garrettbruner@utexas.edu

January 20, 2023

Honoring Yves Duhoux: A Tribute

du-o-u-ka-te do-ro di-do-si mu-ke-no-ro-ko

proposed by

Tom Palaima Anna Panayotou-Triantaphyllopoulou Carlos Varias García

Yves Duhoux was born during the Second World War in 1942. He now has eighty years of life behind him and fifty-five years as a published scholar in Greek, especially Mycenaean studies broadly defined, and Eastern Mediterranean scripts. For ‘two entire generations’ of scholars, as Maurizio del Freo puts it, Yves has been a mentor and a guide. His influence began to be felt in Mycenology with his first entry in Nestor, his classic study: “Le group lexical de didōmi en mycénien,” Minos 9:1, 1968, 81-108. His bibliography now numbers 473 items and counting.

We have gathered here what Alberto Bernabé calls a ‘collage’ of reminiscences from the community of scholars who work on Aegean scripts and languages and prehistory. Our accounts all speak to the wide and deep influence Yves Duhoux has had on our collective and individual scholarly work for over fifty years.

This collection does not just look back, but it looks ahead.

Carlos Varias Garcia, Anna Panayotou and Tom Palaima thought up and proposed this on-line tribute in October 2022, not only to be a fitting reminder of the magnitude of Yves’s service to our scholarly work and the contagious nature of his ever-present and literal enthusiasm, collegiality and reverence for the life of the mind, but also to get us thinking about problems that Yves has worked on that might be good topics for papers when we meet in Spain in 2025 at the next Mycenological colloquium.

It has been a pleasure to shepherd these contributions into the form they have here. We give our collective thanks to PASP INSTAP archivist Garrett Bruner for making all this happen on-line.

Garrett knows Yves well, having archived the substantial correspondence Yves and Tom Palaima have maintained since the 1980’s. And Garrett at the very end of 2022 told Tom that, when he first started working in PASP in 2017, Joann Gulizio said to him that the best place to start on Linear B is Yves Duhoux and Anna Morpurgo Davies, A Companion to Linear B. Garrett began with Ruth Palmer, “How to Begin?” Companion volume 1, 25-68 and to this day continues to recommend it to all PASP archives assistants as fundamental reading. Garrett is grateful for the guidance this companion trilogy has given him and all students of Aegean scripts and cultures.

A full bibliography of Yves’s published scholarship edited by Anna Panayotou is found at the end of the individual tributes to Yves and his work.

When Mycenology we review

Back to nineteen fifty-two

All roads lead back to or through

Our Belgian comrade, Yves Duhoux.

He shows us what we thought we knew

Still has problems to pursue

And ψευδὴς δόξα to undo

Our wise professor, Yves Duhoux.

INDIVIDUAL REMINISCENCES IN ALPHABETICAL ORDER

Francisco Aura Jorro on Yves Duhoux

El Prof. Yves Duhoux, el hombre alto y bueno que sabe de micénico (y de otras muchas cosas)

De entrada, debo decir que me parece excelente la idea de quienes han urdido este modo de homenaje a nuestro colega, amigo y, por lo que a mí respecta, maestro.

Supongo que una parte, sino la mayoría, de las contribuciones con las que se quiere honrar su figura han optado por resaltar sus logros filológicos en el micénico y, más en general, en el griego antiguo. Tendrán mucho y bueno que decir, porque mucho y bueno es lo que ha hecho Yves.

Por mi parte, prefiero resaltar una de las muchas facetas, todas buenas, de la personlidad del Maestro. Su bondad. Y de ello ofrezco el ejemplo que sigue.

Era la tarde del 3 de mayo de 1995, se celebraba el X Coloquio Internacional de Micenología, en Salzburg, un principiante leía, en español, su contribución, cuyo texto en francés, previamente a su lectura, se había repartido; entre los asistentes. Según iba leyendo el comunicante, de vez en cuando, levantaba la mirada y veía, con preocupación, como el Prof. Duhoux iba haciendo anotaciones sobre el texto repartido. Los nervios del ponente iban a más. En su atribulada opinión, las notas del Prof. Duhoux no podían ser otra cosa más que correcciones al contenido del texto. Acabada la lectura, con la corespondiente cortesía por parte del auditorio, el Prof. Duhoux, levantándo su alta humanidad, se acercó sonriente y felicitó efusivamente al ponente, a quien entregó el texto de la comunicación en el que lo que había corregido, pacientemente, era su francés. Como todos habrán podido sospechar, el sujeto era yo.

Gracias Yves, una vez más, por tu amistad y generosidad.

Paco.

Francisco Aura Jorro

Professor of Ancient Greek Language and Literature Emeritus

Universidad de Alicante

Federico Aurora on Yves Duhoux

I have not yet had the fortune to meet Yves Duhoux in person, but my first meeting with his work was when I was a student, when I read his Introduction aux dialects grecs anciens (back then in its Italian translation) and his Le verbe grec ancien: Éléments de morphologie et de syntaxe historiques. Later, his many articles on the Mycenaean language and his anthology for the first volume of the Companion to Linear B: Mycenaean Texts and Their World that he edited with Anna Morpurgo Davies, have become frequent readings in my ongoing work of linguistic annotation of the Mycenaean texts. And in this work, of course, I always try to keep in mind Yves Duhoux’s methodological recommendations from the opening chapter of the Companion’s second volume (Interpreting the Linear B records: some guidelines) – and to practice them with controlled flexibility, as he puts it.

Federico Aurora

University of Oslo

John Bennet on Yves Duhoux

I first met Yves Duhoux in person in April 1988, at the colloquium on ‘Problems in Decipherment’ held in Madison, WI to honour Emmett L. Bennett, Jr, who had recently retired from his academic post. With promptness more characteristic of Yves than of either of his co-editors, the proceedings appeared the following year in the BCILL series. As a then-junior faculty member, I was flattered to be invited to co-edit the volume with Yves and Tom Palaima, and realise now, in retrospect, that this generosity and encouragement to early-career scholars is typical of Yves. The last time I met Yves in person was 30 years later, in December 2018 in Durham, UK, at a small colloquium on Linear B. Sadly on that occasion Yves suffered a fall on newly fallen snow, broke his hip and spent rather longer than anticipated in Durham. Many of us would have struggled to recover, but it is testimony to Yves’ optimism and strength of spirit that he bounced back and we now have the opportunity, almost exactly four years later as I write these words, to wish him many happy returns on his 80th birthday!

Yves’ scholarly output is prodigious. The Nestor database lists 125 works, reaching back to his first Minos article published in 1968, a turbulent year in Europe.

Like all his Mycenological colleagues, I continue to receive pdf versions of his most recent publications via email, further testimony to his characteristic generosity and productivity. His greatest contribution to our field is arguably the three-volume Companion to Linear B, co-edited with another outstanding figure, the late Anna Morpurgo Davies. These three volumes have probably done more to engage scholars outside the ‘inner circle’ of Mycenaean Studies than any other English-language publication. Only the much-anticipated New Documents in Mycenaean Greek is likely to supersede it when it appears next year.

The Companion is an enduring testament to Yves, truly a ‘towering’ figure – figuratively and literally – in our field.

Χρόνια πολλά!

John Bennet

University of Sheffield

Alberto Bernabé on Yves Duhoux

Mi contribución a este improvisado “collage” de testimonios para glosar la personalidad de nuestro extraordinario colega, con el que he tenido el honor de coincidir en varias ocasiones, y al que aprecio profundamente, no va a referirse a su incuestionable aportación a los estudios de micenología (que se manifiesta, por ejemplo, en las múltiples ocasiones en que es mencionado en la segunda edición del Diccionario Micénico que preparamos), ni a su cordialidad (que lo lleva a insistir siempre en que le hable en español). Voy a referir un suceso en el que estuve presente, que refleja con claridad la profesionalidad de Yves, el respeto a sus colegas y, en general, su carácter. Durante un pequeño coloquio celebrado en Durham, en diciembre de 2018, caminábamos de noche por las pendientes y resbaladizas calles de la ciudad, cubiertas de agua y hielo tras una reciente nevada, cuando una joven se vino tambaleando cuesta abajo e impactó en Yves, enviando su alto cuerpo al suelo. Cuando nos acercamos para ayudarlo a levantarse, sentado como estaba en la acera nevada y apoyado en un automóvil, nos advirtió con enorme serenidad que no podía levantarse y que podía ser una lesión seria. Mientras se organizaba la petición de ayuda profesional, en lugar de quejarse o maldecir, como habríamos hecho cualquiera de nosotros, Yves, pensando en los demás, antes que en sí mismo, lo primero que hizo fue señalarnos dónde estaba la comunicación que debía presentar al día siguiente, para que alguien se la leyera. Creo que no cabe mejor definición de su actitud científica y su personalidad.

Alberto Bernabé

Profesor Emérito. Universidad Complutense

Margarita Buzalkovska-Aleksova on Yves Duhoux

I first met in person Yves Duhoux on the Mycenaean Colloquium in Ohrid in 1985. I had just delivered for public presentation my MA thesis ‘Prepositions and prefixes in Mycenaean Greek’ and I had already known him from his book Aspects du vocabulaire économique mycénien (cadastre – artisanat-fiscalité), 1976. While consulting the rich bibliography for the thesis, as a young scholar I found this work more easily comprehensible because of the strictly precise analysis of the Mycenaean documents and consequently the most logical conclusions that were coming out of it. When I heard the presentation of his paper at the Colloquium, it was so intriguing and interesting that I wished to read the final version of it instantly myself. And that impression or feeling remained with me after Yves’s papers at all the following Colloquia. His papers have been very inspirational to me leading me to more work and reexaminations.

Yves has also never missed to share by e-mail, with us, his colleagues and friends, a lot of his valuable papers immediately after being published in many eminent journals, for which generosity we are deeply indebted to him.

The devotion of Yves Duhoux as editor (together with Anna Morpurgo Davies) in the field of Mycenology is shown in his painstaking work on the three precious volumes of A Companion to Linear B: Mycenaean Texts and their World I (2008), II (2011) and III (2014), companion volumes that are essential for every scholar and student in the field of Mycenaean Studies. Besides having the initial idea for this tremendous source book and the huge responsibility for editing the volumes, he also contributed his own text (Chapter 9) in the first volume: ‘Mycenaean Anthology’ (243-394) comprising the precious results of his study of many subjects concerning the Mycenaean Civilization as a whole.

Thank you, Yves Duhoux!

Margarita Buzalkovska-Aleksova

Professor Emeritus, Institute for Classical Studies, University of Ss. Cyril and Methodius

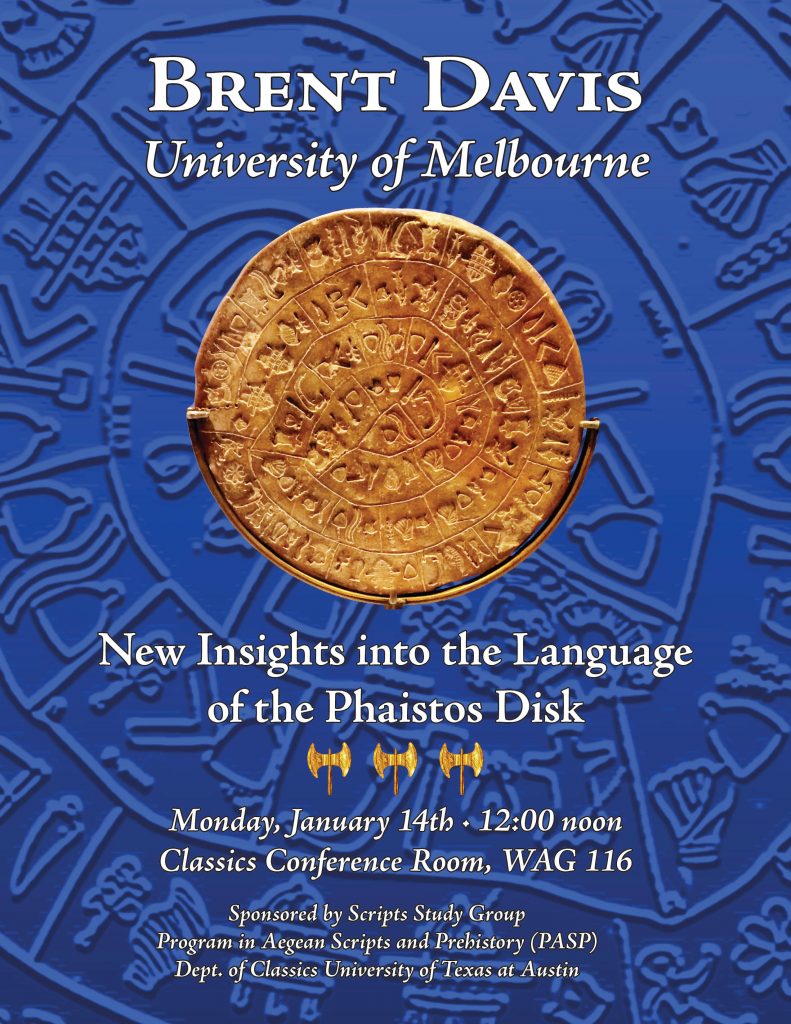

A Tribute To Yves Duhoux by Brent Davis

I welcome these well-deserved expressions of appreciation, admiration and gratitude for Prof. Yves Duhoux, for his lasting work, and for the inspiration he has given to countless students and colleagues. As a specialist in the scripts of the Bronze Age Aegean, I would like to pay particular attention and tribute to his remarkable contributions toward our understanding of the undeciphered members of this family of scripts, and of the languages that underlie them.

Those of us who work in this field know its character: these scripts are relentlessly stubborn about giving up their secrets, while at the same time the field itself (by its nature) tends to attract all manner of wild-eyed enthusiasts and would-be decipherers. As a result, the study of these scripts through much of the 20th century consisted of a barely-controlled free-for-all, marked by unhinged hypotheses, deplorable methodologies, and almost no established standards in place for sifting the wheat from the chaff. This grievous situation began to change in the late 1960s with the work of Elizabeth Barber and David Packard, but Duhoux was the seed around which a new crystal of lasting sanity began to form in the 1970s. From the beginning, his work changed the paradigm completely, and he brought a welcome order to the chaos.

In May 1948, Alice Kober, whose work on Linear B was so instrumental in Ventris’s decipherment of that script, gave a lecture at the Yale Linguistics Club in which she asserted that anyone who aspires to decipher a script without the benefit of a bilingual text must be willing to inhabit a land of “form without meaning”, and to inhabit that land for as long as it takes—in other words, to be willing to find ways of extracting information from the signs and inscriptions themselves, without any idea what those signs and inscriptions might mean. Kober put her words into action by using a brilliant combination of linguistics and logic to produce her Linear B “triplets” and phonetic grid, thus revealing aspects of the morphology and phonology of the language underlying the script, and paving the way for Ventris’s eventual triumph. Today, for those of us struggling to study (and perhaps someday to decipher) the still-undeciphered members of this family of scripts, Duhoux has acted for decades as our Kober, pioneering and pointing the way by revealing aspects of the languages underlying these scripts through a dazzling admixture of linguistics and logic.

Some of the work that he has produced in this field was published almost half a century ago, yet it remains as current and as relevant as it was on the day it first appeared. He has created, for example, impressive comparative studies aimed at determining whether different undeciphered Aegean scripts encode similar languages, such as ‘Les Langues du Linéaire A et du disque de Phaestos’ (Minos 18, 1983), or ‘Eteocypriot and Cypro-Minoan 1-3’ (Kadmos 48, 2009). He has given us the definitive monograph on the Phaistos Disk (Le Disk de Phaestos, 1977), and has demonstrated beyond doubt that the undeciphered inscription on the Disk contains the most ancient known example of the systematic use of rhyme (‘L’écriture et le texte du disque de Phaistos’ in Proceedings of the 4th Cretalogical, 1980).

But perhaps his linguistics-based analyses and assessments of Linear A shine most brightly as wonderful exemplars of the advances in the study of an undeciphered script that can be achieved by rigorously inhabiting Kober’s world of “form without meaning”. Examples abound, such as ‘Une analyse linguistique du linéaire A’ (in BCILL 14, 1978); ‘Le Linéaire A: problèmes de déchiffrement’ (in BCILL 49, 1989); ‘Variations morphosyntaxiques dans les textes votifs linéaires A’ (Cretan Studies 3, 1992); ‘La langue du linéaire A est-elle anatolienne?’ (in Antiquus Oriens, 2004); or ‘Linéaire A ku-ro, “total” vel sim.: sémitique ou langue “exotique”?’ (Kadmos 50, 2011). Many of these works have achieved legendary status because of the impeccably rigorous way in which he constructs and argues them, and because of the utterly convincing way in which he uses the script and inscriptions themselves to tease out the morphosyntactic characteristics of the underlying language(s) without ever stepping into the snare of trying to identify the language itself. In fact, he teaches us precisely how to contribute something meaningful to the study of this script (or any undeciphered script) despite the absence of an identification of the underlying language, and this makes his work and the methods he teaches more valuable than diamonds. For me, reading his work was a revelation: I saw at once that this admirable scholar had found the right way forward and was mapping it out for us, and I and many others in this field now do our best to follow in his footsteps.

In the late 1790s, following a resolution by France’s Convention nationale, a number of marble plaques displaying the Mètre Étalon (‘Standard Meter’) were mounted at the most frequented spots in Paris to encourage the use of the new metric system. Most are now gone, but one venerable example still remains on the façade of the Ministry of Justice in Place Vendôme. For those of us who have devoted our lives to the study of the undeciphered scripts of the Bronze Age Aegean, Duhoux has become our Mètre Étalon: he is the standard against which we measure our own work, and his principles and methodologies, proven invaluably productive over time, are the ones we have adopted as our own and are now passing forward to the generation that comes after us. For this, we all owe you the deepest debt of gratitude, Professor. Longue vie à vous!

Dr Brent Davis

Dr Brent DavisSenior Lecturer in Archaeology and Ancient Egyptian

School of Historical and Philosophical Studies

University of Melbourne

Maurizio Del Freo on Yves Duhoux

It gives me great pleasure to contribute to this initiative in honor of Yves Duhoux, as it allows me to thank him personally both for the valuable contribution he has given and continues to give to the study of the Aegean and Cypriot scripts and languages of the 2nd and 1st millennium BC and for the affability and kindness he has always shown in our personal relations. My reading of his written scholarship, starting with Aspects du vocabulaire économique mycénien (1976), as well as the conversations I have had with him afterwards, were together an important source of inspiration for my research, especially in relation to the issue of the Mycenaean land registers. Personally, I consider his entire scientific output to be an example of lucidity and accuracy. I firmly believe that each of his scholarly contributions is essential to our field for three characteristics: (1) a correct framing of the problems, (2) a critical evaluation of the existing hypotheses and (3) the innovative ideas Yves puts forward. With his research and scientific production Yves has contributed to form two entire generations of scholars in our field. For this he deserves our deep gratitude together with the heartfelt wish that he can continue to dedicate his talent and ingenuity to us for a long time to come.

Maurizio Del Freo

Dirigente di Ricerca

Istituto di Scienze del Patrimonio Culturale

Consiglio Nazionale delle Ricerche

Roma

Cassandra Donnelly on Yves Duhoux

On the occasion of his 80th birthday, I wanted to thank Yves Duhoux for his contributions to the study of Aegean Scripts and provide him with a sense of how his work is impacting me as someone in the most recent cohort of new doctors. Yves Duhoux has been with me throughout my years as a graduate student and into my first year as a doctor, though we have never had an opportunity to meet. His works are foundational, accessible, and on subjects that are a little off-the-beaten path in Aegean scripts, which makes them of particular interest to me. The first introduction I had to Duhoux was in my first semester as a graduate student, when Tom Palaima instructed me first thing to read through the Companion to Myceanean Greek, vol 1. Even with an advisor as supportive and knowledgeable as Tom and in a program as specialized as PASP, the Companion was absolutely essential to introducing me to the field’s conventions and scholarship. He is exemplary in his role as editor and collaborator.

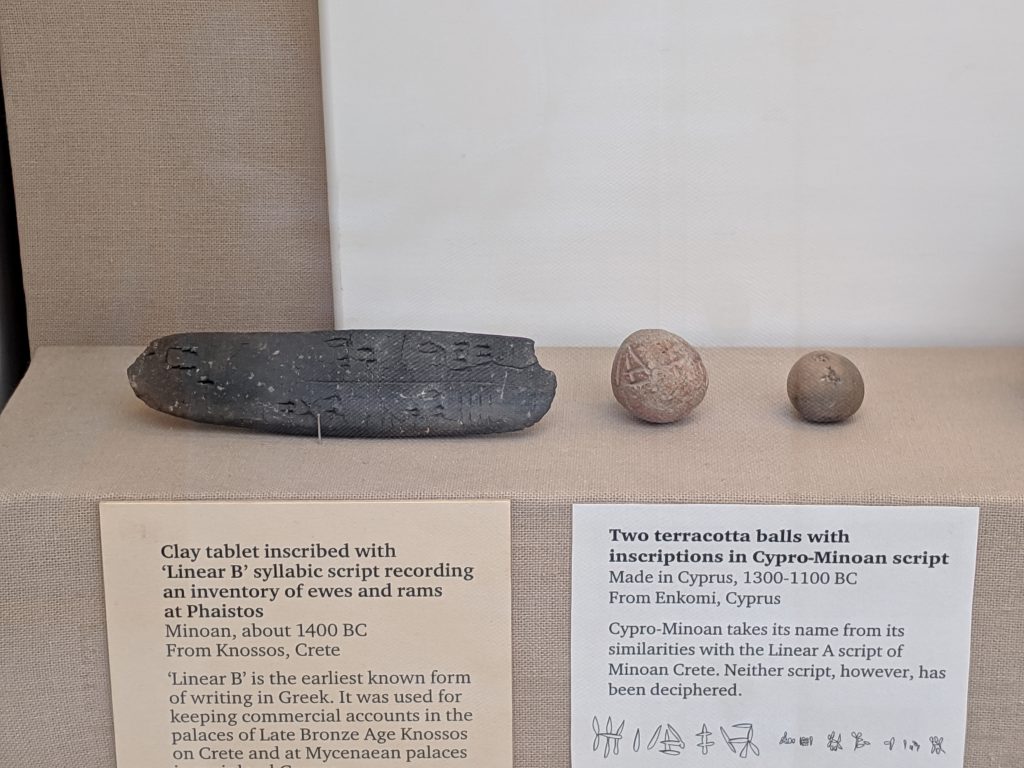

Subsequent to my early years as a graduate student, Duhoux’s individual scholarly contributions have become integral to my work on Cypro-Minoan. His works on Cypro-Minoan are invaluable for their clear documentation and presentation of evidence. His unflagging cataloguing the number of signs and words in Cypro-Minoan led to the identification of the few underlying grammatical patterns in the script that we have. Duhoux stands out to me for the way he consistently situates script and inscriptions in their diachronic contexts and for the way he weaves in multiple strands of evidence from the archaeological, to the literary, and mathematical approaches to decipherment. He is to be congratulated and celebrated for his high-quality scholarship and his contributions to the study of Cypro-Minoan that will surely live on.

Dr. Cassandra Donnelly

Postdoctoral Researcher, ComPAS Project

University of Cyprus

Elena Džukeska on Yves Duhoux

Professor Yves Duhoux’s work in the field of Mycenology and Greek philology has always been an inspiration and a guide for me. All his writings are without exception examples of methodology, true scholarship and profound insight for us to follow. His achievements are valuable contributions not only to the study of Greek language and Aegean scripts but to the study of history of language and script in general. We are indebted to him for his exceptional work and I hope and wish that we will be able to welcome new projects and studies from him and learn from him for a long time to come.

Elena Džukeska,

Professor of Greek and Latin language at the Institute of Classical Studies, Faculty of Philosophy, “Ss. Cyril and Methodius” University in Skopje

José Luis García Ramón on Yves Duhoux

Hay dos trabajos de Yves Duhoux que me han impresionado desde el momento en que los leí.

Por una parte, su estudio de las diferencias entre el Lineal B de Creta y del continente (Ohrid, 1985) sobre la base de una decena de “éléments de comparation”: un trabajo modélico por su claridad y por la precisión de su análisis, que solo cabe lamentar, en mi opinión, … que Yves no lo haya actualizado y ampliadoa la luz de los nuevos textos, también de otros centros, publicados en los últimos decenios: no pierdo la esperanza de que vuelva sobre el tema quizá en Madrid 2025.

El segundo trabajo, « La syntaxe mycénienne: à propos de la notion de ‘faute’” (Atti Roma 1968) hace ver, sobre la base de casos procedentes de diferentes centros, que formas casuales contrarias a lo esperado reflejan “simple yuxtaposition de termes, non accordés syntaxiquement … ” y, menciona, entre otros, el caso de ka-ra-e-ri-jo, me-no en Cnoso: es, en mi opinión, la mejor explicación — como es la de John Chadwick ( “Error and abnormality”, 1958) para las incoherencies sintácticas en las tablillas de la serie D– de Cnoso. Una aproximación en esa línea a los casos en que el contexto o la función de la forma en la tablilla son tan transparente que hace innecesaria la desinencia, se habría evitado la proliferación de pretendidas explicaciones morfológicas para formas que no las necesitan.

Margherita Jasink on Yves Duhoux

It is a pleasure and an honor for me to have the opportunity to express my grateful admiration for Yves Duhoux, a great scholar I have had the pleasure of knowing at various meetings and conferences. His studies on Mycenaean history, philology and linguistics constitute a classic fundamental reference. They have been an inspiration for many scholars, among whom I certainly include myself. I particularly like to remember a meeting with Yves in Florence during a conference dedicated to historians and Linear B, on the occasion of which I felt very proud to present a work with, at my side, Yves Duhoux on one side and Pierre Carlier on the other. Although now distant in time and place and part of the past, this is for me a very beautiful memory of a great researcher and a lovable character.

Margherita Jasink

José Miguel Jiménez Delgado on Yves Duhoux

No es fácil expresar en pocas palabras la influencia que los trabajos del profesor Duhoux han tenido no solo en mi producción científica, sino en la de varias generaciones de micenólogos, helenistas e historiadores. Mi interés por los textos micénicos fue siempre lingüístico y en sus trabajos encontré la conjunción de un profundo conocimiento de la lengua griega y de una estrecha familiaridad con los textos micénicos que siempre he pretendido alcanzar, con éxito relativo. Su producción, que continúa creciendo sin interrupción, es tan extensa que es difícil elegir un título como especialmente relevante sobre los demás. Con todo, no puedo resistirme a recalcar la utilidad y maestría de su antología micénica en el Companion to Linear B, donde se condensan todas las vertientes del estudio de esos textos, la epigráfica, la lingüística y la filológica. Tampoco puedo dejar de reconocer la generosidad del profesor Duhoux, siempre dispuesto ayudar a los que empiezan, a compartir sus ideas y a facilitar los materiales que se le soliciten, dentro del más puro espíritu de Gif. Por último, Yves Duhoux es una persona afable y educada, muy agradable en el trato, como he podido comprobar en alguna ocasión en la que he coincidido con él y en la que, además, descubrí que habla español con gran soltura. Espero que podamos disfrutar de su compañía y de su ciencia todavía muchos años más.

José Miguel Jiménez Delgado

Associate Professor of Greek Philology

University of Seville Spain

John Killen on Yves Duhoux

The Late Anna Morpurgo Davies, who collaborated with Yves in more than one venture and of whom Yves wrote a moving obituary in Minos 39, once told me that of Yves’ many talents there were two that she particularly admired: the great clarity of his writing and his entrepreneurial skills. (Anna was thinking here of Yves’ initiative in launching the volumes in which they collaborated as editors: the splendid Companion to Linear B (3 vols 2008, 2011, 2014) and, earlier, Linear B: a 1984 Survey (1985), the proceedings of the Mycenaean section of the FIEC Congress in Dublin.

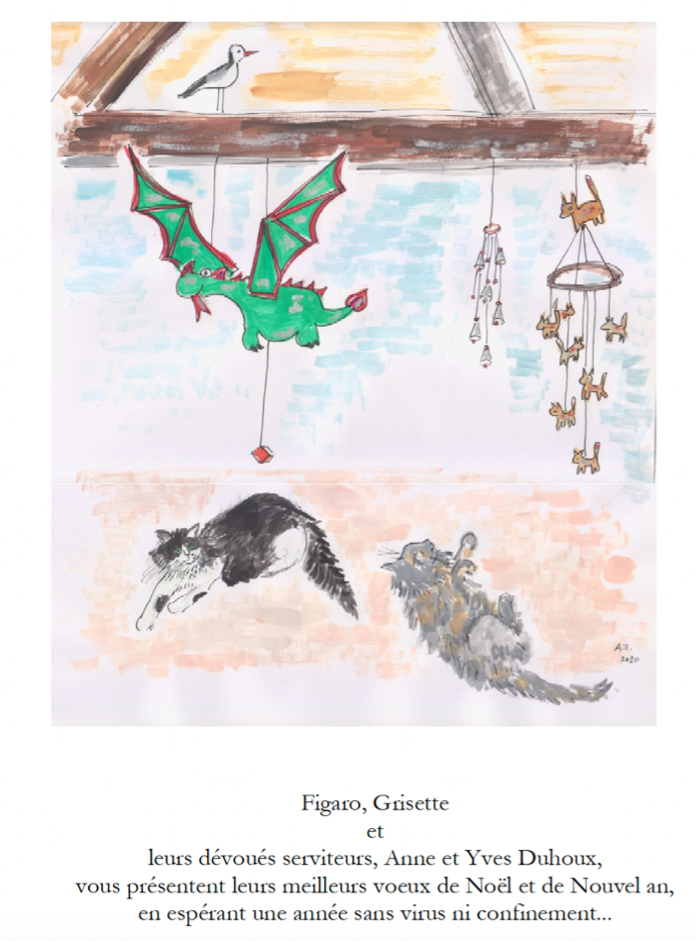

I first met Yves in the 1970s, when he came to work with John Chadwick in the Mycenaean Epigraphy room in Cambridge, then, in its old location in the Mill Lane overlooking the Mill Pond. We have kept in friendly contact ever since, and it is always a pleasure to receive Yves’ New Year card (now in digital form) with its delightful drawings of the family cats.

Before Yves arrived in Cambridge, he had published an excellent article on ‘Le group lexical de didōmi en mycénien’ (Minos 9), and about the time of his visit followed this with two admirable discussions of ideograms: the first in Kadmos 14 on *168 and *181, the second in Minos 15 on *146, *160, *165 and *166. Shortly after came the publication of Aspects du vocabulaire économique mycénien (1976), in which amongst other topics Yves discusses land tenure and ‘industrial’ production under the ta-ra-si-ja system. So impressed were Anna Morpurgo Davies and I by Aspects that we decided to invite Yves to write chapters on these two topics for Documents³ (now New Documents). In response, Yves has written two excellent chapters in impeccable English and with the clarity of exposition that Anna so admired.

Since the 1970s, Yves has been the author of a great stream of stimulating publications on a formidable range of topics, ranging from Linear A to the LH/LM III-AB inscribed stirrup jars. He has also been an invited participant in all Mycenaean colloquia since Chaumont (1975). It is difficult to think of many scholars working on our subject matter who are as deserving as Yves to be honored by his colleagues.

J. T. Killen

Evangelos Kyriakidis on Yves Duhoux

Yves has always been a kind-hearted, polite, engaged scholar, someone who that enjoyed a good debate, someone passionate about the world of ideas. Extremely hard working and prolific, he has seriously impacted linguistics and the Aegean scripts. I remember Yves having coffee with other colleagues in Canterbury and enjoying these great, simple things in life: the dim English sun, the conversation, the friendship. A great scholar, a loyal friend, a passionate thinker. Thank you, Yves, for who you are to all of us in the fields of Aegean scripts and linguistics.

Evangelos Kyriakidis

University of Kent

Hedvig Landenius Enegren on Yves Duhoux

Professor Duhoux was very kind to me when I moved to Belgium with my family and continued my research there in the early 1990s. I used the university library at Louvain-la Neuve often. During this time Yves Duhoux introduced me to statistical methods applied to Linear B material. Although I eventually chose to use a different statistical approach in my doctoral thesis on the personal names in the Knossos tablets, his methodology was key to my exploring the topic at all! I am indebted to Yves for this and for his wide range of expertise in matters Linear B!

Hedvig Landenius Enegren

Michael F. Lane on Yves Duhoux

There are giants on whose shoulders some stand, while others will never even measure up to their knees. Prof. Duhoux is such an intellectual giant, and I belong to the latter, toddling category, ever reaching up for assistance. What is there that I have not taken and used from the hand that offers so much and such variety? The grammar, morphology, and phonology of Greek from the Bronze Age to the Classical Period? The position of Mycenean Greek among cognate dialects and Indo-European languages more broadly? The identity of origins of languages of Bronze Age and Iron Age Crete? The linear scripts of the Bronze Age Aegean and Cyprus, and their descendants?

Yes, all the above. But that for which I am most grateful is the meticulous attention he has devoted to the technical terminology of Mycenaean palatial economic administration especially early in his career but also again in recent years. This ranges from the major categories of landholding—ki-ti-me-na, ke-ke-me-na, and ka-ma—to the reflexes of *deH3– ‘giving’ in Mycenaean Greek and their contextual meanings, to such terms for the division of manufacturing labor as o-pa and ta-ra-si-ja that have been the subject of productive lines of economic historical inquiry lately.

Prof. Yves Duhoux’s work has not simply been among my inspirations further to explore the relationship between land allocation and proportional tribute (and distributions), a topic internal to the Linear B archives and the subject of a chapter in his germinal Aspects du vocabulaire économique mycénien, but it has also encouraged me to see whether the scribes’ observations can be modeled and operationalized in archaeological field investigations.

Thank you, Yves, if I may, for the inspiration and impetus you have given me at the start of my career as a scholar.

Michael F. Lane

University of Maryland, Baltimore County

Susan Lupack on Yves Duhoux

I often say to my students that the work that I and all of those in my Linear B cohort do today is only possible because of the work that was done before us. We are standing on the shoulders of the giants of our field (or sometimes I feel more like we are trying to climb up onto those shoulders!) – and Yves Duhoux is definitely among those giants. I remember when I was first working on the land tenure section of my thesis. I was nearly overwhelmed by the different terms found on these tablets, and the seemingly endless possibilities of what they could signify. But the one who shone a light through those endless possibilities was Duhoux. I returned to his definitions – and the sensible reasoning that he provided for them –again and again. In particular, I kept his 1976 Aspects du vocabulaire économique mycénien close at all times. And today, I still consult that book – as well as the numerous other publications that he has put out since then – but I can’t help highlighting Aspects du vocabulaire économique mycénien because of how foundational it was for my own work.

May I also relate that because of my impression of him as one of the giants – and his physical demeanor did nothing to dispel this image – I was somewhat in awe of him at the first conferences that I attended. This is perhaps why it meant so much to me when I heard that he had made a very generous remark of praise to Tom about me and the other PASPians who were presenting at that time. From then on, my appreciation of Duhoux as a person grew, an appreciation that is renewed every year with the receipt of one of his whimsical Christmas cards featuring his cats Figaro and Grisette. I save them! And I’d like (if it seems appropriate to the editors) to revive the one from 2020 for us all here. It lifted my spirits quite a bit when I saw it. So, I’d like to say, Thank you Yves, for all that you’ve thought, put down in writing, and edited for our field – and thank you as well for the playful kitty Christmas cards!

With my warm regards,

Susan Lupack

Senior Lecturer of Greek and Roman Archaeology

Director, Bachelors of Archaeology

Co-Director Perachora Peninsula Archaeological Project

Macquarie University

Torsten Meißner on Yves Duhoux

It was a very cold winter’s day in, I think, February 1986 when a new book arrived at the Sprachwissenschaftliches Institut of the University of Bonn, the title of which was “Linear B: a 1984 survey”, edited by Anna Morpurgo Davies and Yves Duhoux. Just having started out as a freshman, and never having heard of this enigmatic but intriguing sounding “Linear B” before, I picked up the book; the first article in it was “Mycénien et écriture grecque”, written by Yves. I read it and was fascinated, in fact, captivated. At the time, the young undergraduate found the clarity of exposition that so much was and is the hallmark of Yves’ academic writing, particularly helpful. The next chapter was Anna’s “Mycenaean and Greek Language”, and I devoured that, too, and the entire rest of the book. In fact, the following day I ordered my own copy. This was my first book on Mycenaean, and it sits on my bookshelf to this day.

A lot has happened since, and over the years, as an undergraduate, graduate and post-Doc I came to appreciate not just the clarity but the magisterial authority behind it that made this clarity possible, the sheer sense of what was said, and the fine attention to detail, be it on matters Mycenaean, Linear A or Eteocretan. It was only 20 years later, at the Rome colloquium, that I finally met Yves in person, and it was a great pleasure to discover that he speaks with the same clarity as he writes. Many other happy occasions were to follow, and I will never forget discussing a broad range of topics, from word division in Linear B to the Prix Ysaÿe, with him. Over the last 35 years or so Yves has been a guiding light for me in the study of the Aegean scripts and languages, and for this I am eternally grateful. Ad multos annos!

Torsten Meißner

University of Cambridge

José L. Melena on Yves Duhoux

It was during my last year of studies at the University of Salamanca (1969) when I first made the acquaintance of Yves Duhoux. From 1962 onwards, i.e. at San Sebastian High School, I was very interested in Mycenaean script. During this time I read articles in Minos and knew that Ruipérez was its editor. I went therefore to Salamanca in 1965 to study Classical Philology in the hope to be eventually trained in the subject of Mycenaean Greek by Professor Ruipérez. “Mycenaean Language” was, scheduled to be taught in my fifth year (1968-70). However, Ruipérez moved to the University Complutense at Madrid in 1969. But by a simple twist of fate, I ended up with an assistantship to Ruipérez in Madrid. The rest, as they say, is now history.

During my academic courses (1965-1970), I independently did sporadic readings of the issues of the periodical Minos which was easily available in the bookstores at Salamanca. In this way I had the pleasure of reading Yves Duhoux’s paper in Minos 9 on “Le groupe lexical de didomi en mycénien” and learning a lot about the right method for approaching a philological analysis in Mycenaean. I also came to know that Yves was working on a PhD dissertation on Le vocabulaire économique mycénien under the joint direction of Professors Lejeune (Paris) and Maniet (Louvain).

A few years later we coincided in sharing space in Minos 13, 1972, where my first Mycenological paper «On the Knossos Mc Tablets» was followed in the issue by his «Mycénien e-ke-qe / e-ko-si-qe». Yves read my paper and wrote me with his ideas supporting my view that the goat logograms on the Mc tablets represented not living animals but their hides or skins. This was the beginning of a friendship that for me has been and still is a most valuable, unfailing gift.

Since I was not invited to join the Mycenaean Colloquium at Chaumont in 1975 (for participants and photos see in academia.edu Rudolf Wachter, Colloquium Mycenaeum 1975 at Chaumont sur Neuchâtel [Switzerland]) which Yves was attending, our first physical meeting was delayed until the next Colloquium at the Zoo Park of Nuremberg in April 1981. We have met as friends since then at every Colloquium on Mycenaean Studies except when I failed to attend.

Leaving aside the material published over the years in Minos which I carefully read while editing the journal, I have been an enthusiastic follower of Yves’s writings since the 1976 publication of his PhD diss. Aspects du vocabulaire économique mycénien: Cadastre, artisanat, fiscalité, which became for me a landmark in our studies as was his Le verbe grec ancien: Éléments de morphologie et de syntaxe historiques of 1992 in the realm of Greek morphosyntax (2nd revised and augmented edition in 2000). I liked at once his way of treating the different subjects. On the other hand, his monumental joint edition with the late Anna Morpurgo of the A Companion to Linear B: Mycenaean Greek Texts and their World. 3 volumes, Peeters, Louvain, vol. 1: 2008, vol. 2: 2011, vol. 3: 2014, granted him a golden place in the History of the Mycenaean Studies. There is no subject in our realm left untouched by Yves Duhoux and his contributions remain indispensable when approaching any question. This will continue to be so in the future.

Nevertheless, the high level of Yves’ scientific production actually pales when we compare it to the magnitude of his kindheartedness. In late August, 2003, four members of our family (including our two sons) died in an aircraft crash. This accident blew up our lives and my wife, daughter and myself remained dismantled for many years. The sad ambiance did not allow any activity except for survival living. While my other Belgian friend and colleague chose to be deaf during these years, Yves was continuously at my side encouraging me to restart working, especially on fulfilling the commitment I had made to produce a contribution to the Companion on the subject of Mycenaean Writing.

As can be well understood, it was extremely difficult to attempt to launch a paper on this large scholarly subject in view of the lasting effects of the unbearable sorrow felt by my wife and me. I delayed year after year to do it. But Yves never gave up and finally he offered to travel to Vitoria in order to work alongside me in writing my contribution. At last, I managed to write an enormous highly technical piece, some two hundred pages. It was accepted and praised by Anna and Yves, who undertook the equally enormous work of correcting and polishing the material. I finally reached the goal in volume three but only because I could stand on the shoulders of these two giants.

Many thanks, Yves, for being my long-time loyal and constant friend.

José L. Melena

Professor Emeritus

University of Basque Country, Spain

Stephie Nikoloudis on Yves Duhoux

Having Professor Duhoux at the frontline of Linear B scholarship affords me the opportunity to learn from an excellent scholar whose probing questions improve my work and whose collegiality makes me feel welcome among elite scholars who have paved the way for so many of us. Clarity characterises his contributions, in print and in person. Everyone knows that what he has to say will be sound and significant. My research benefits enormously from his work, for which I thank him wholeheartedly!

Stephie Nikoloudis

Lecturer and Coordinator, Greek Studies

Department of Languages and Cultures | School of Humanities and Social Sciences

La Trobe University

Marie-Louise B. Nosch on Yves Duhoux

Professor Yves Duhoux’s scholarship has guided and inspired me ever since I started studying Linear B. His works were my entry into the Mycenaean world. For my master thesis in a French University on Mycenaean craftsmanship, it was his 1976 monograph Aspects du vocabulaire économique mycénien (cadastre –artisanat –fiscalité) that guided my studies and interpretation of the Linear B tablets, especially the section on artisanat. Here I learned both a French and a Mycenaean Greek technical vocabulary of craftsmanship, apprenticeship, occupational names and tools. His monograph is still one of the best and most comprehensive studies of Mycenaean society — and especially the section on artisanat. Many studies have since 1976 approached Mycenaean taxation and landholding but crafts as an economic, social and technical part of society is best treated in Aspects.

My interests in textiles gave me the opportunity to study two other seminal papers, Duhoux, “Idéogrammes textiles du linéaire B *146, *160, *165 et *166,” Minos 15 (1974) 116-132, and Y. Duhoux, “Les idéogrammes *168 et *181,” Kadmos 14 (1975) 117-124. Here Yves Duhoux aimed at identifying textile types, by comparing logograms, textile terms, iconography and archaeology. A challenging task and even a riddle. In some ways, I have tried to continue solving this riddle and fulfilling the task that Duhoux established; and it is not a coincidence that I very often quote these two papers in publications, because they have set the agenda and defined the challenges. Textiles in Minoan and Mycenaean societies are still so challenging and enigmatic to us, 3500 year later.

I have especially appreciated Yves Duhoux’s multidisciplinary approach: founded on philological grounds, informed by paleography, and with a sense practique of what is feasible and realistic. Thank you, Yves, for these many gifts to me and to all students of the Mycenaean texts.

Marie-Louise B. Nosch

Professor at the University of Copenhagen

Royal Danish Academy of Sciences and Letters

Tom Palaima on Yves Duhoux

One of the more extraordinary emails, in a positive sense, that I have ever received was sent by Yves Duhoux on March 25, 2009. It reads:

Dear Tom,

I have not got your chapter yesterday, as promised.

I resolve then to do what I swore a few weeks ago; I will come to Austin and stay as long as needed to get your chapter.

Since I am retired, I have all my time free and any period is convenient.

Tell me, Tom, the best time for you.

Ever yours,

I had sent to Yves Duhoux in late March 2007 a MSW file of 6,620 words for what was a chapter on the history of palaeography of Aegean scripts for a handbook then called Linear B: A Millennium Survey. That planned volume has since morphed into the extraordinary 3-volume A Companion to Linear B (2008, 2011, 2014) that is much praised by many contributors to this Tribute as the essential study that it is.

Yves viewed my 2007 text as a down payment on what he envisioned to be a much more systematic and comprehensive survey of the history of the study of the Linear B texts (and also when pertinent the Linear A and the Cretan Hieroglyphic texts), the writing upon them and the writers of the texts and how they were organized. Typical of Yves, he wanted a truly critical assessment of the current state of palaeographical studies and identification of past and current problems and some proposals for ways forward. He wanted the use of writing by Minoan and Mycenaean palatial centers to be CAT scanned and then diagnosed within the context of the contacts that Minoan and Mycenaean cultures had with one another and with the surrounding high cultures of the eastern Mediterranean, Anatolia, Mesopotamia, the Levant and Egypt.

I had promised in March 2007, when I was teaching as a Fulbright Professor at the Universidad Autónoma de Barcelona to try to satisfy his vision, but my promise in two years had not been realized.

I replied on March 29, 2009,

Your disappointment must be as keen as this kind offer, which I will gladly accept, if it is needed.

Let us see how things go between now and May 1.

I have been overwhelmed by other concerns. For one, I was given the opportunity to write a feature piece for the Times Higher Education on Barack Obama as a speaker and his political impact. That was something I had not planned and that I could not very well turn down, given the disastrous course of American politics for the 8 years under President Bush.

So the time I had originally allotted during spring break (March 15-22) for finishing the palaeography chapter went into writing the 5000-word THE piece which will appear next Thursday, April 1. Then the free time in this last week (March 23-27) went to the editorial changes in the THE piece.

When I say free time, I mean the time besides my two new courses, my service as Graduate Studies Chair of my department and on its executive committee, my work on UT’s faculty council, grading graduate exams, meeting with prospective Religious Studies faculty, doing faculty reviews, and this weekend going on a boy scout hiking campout with my son’s troop.

I do not have fully free time.

Way led onto way and delay led to further delay. Finally, the ever gracious and wondrously patient Yves followed through, first proposing, “I guess that about ten days in Austin will be enough to help you to finish your chapter about scribes, scribal hands and palaeography.”

Yves did come to Austin in the summer of 2009. Building upon the basic text of 2007, we did work together every day for ten days in the mornings and afternoons. I wrote in the morning and gave to Yves what I had written. While I wrote in the afternoon, he reviewed what I wrote in the morning. I gave him the afternoon’s work and he gave me his advice on my morning’s work: what topics to take up more fully, what explanations needed illustrations, and where my thoughts might be reconsidered. I worked on these at night and we followed the same pattern the next morning.

The whole experience was exhilarating and led to it being possible in mid-to-late October 2009 to polish and finalize meticulously the 104-page chapter of 34,155 words with 254 itemized references and 51 text figures. It gives a full and then up-to-date history of Linear B palaeography and its importance for making sense of the texts that we possess within the broader scope of writing traditions and literacy in the surrounding ancient world. I have the feeling, however, that Yves would have been happy to spend another ten days doing still more.

In this one case, his devotion to scholarship impelled him to fly across the Atlantic Ocean and then a further half continent to Austin. (See herein Melena on Duhoux, last full paragraph.) His savvy understanding of my temperament and scholarly habits reaches a level known by perhaps three or four other Mycenologists. Yves’s devotion to the good of the field and selfless encouragement of my own work at a time that was also full of personal troubles are remarkable enough to record here in this tribute.

I recently had two occasions to refer to the summer of 2009 and to thank Yves profusely. One was at the end of co-editing with Carlos Varias Garcia and Julián Méndez Dosuna TA-U-RO-QO-RO: Studies in Mycenaean Texts, Language and Culture in Honor of José Luis Melena Jiménez (Harvard University Press Hellenic Studies 94) in summer of 2022. The other was when finishing co-editing with Robert Laffineur Zoia. Animal-Human Interactions in the Aegean Middle and Late Bronze Age (Peeters: Aegaeum 45) in summer 2021. To both of these volumes Yves contributed finely crafted studies.

I wish to close with my great thanks to Yves for using his normal precise methods to analyze clearly (in the sense of breaking up into component parts) the theories proposed by other scholars, particularly during the controversies surrounding the interpretation of the Thebes tablets during the decade 1996-2006 and beyond.

Three of Yves’s articles published in 2006 stand out for their breath-taking scientific integrity and clarity: “La soi-disant “triade divine” des tablettes linéaire B de la rue Pelopidou (Thèbes),” “Animaux ou humains? Réflexions sur les tablettes Aravantinos de Thèbes,” and “ADIEU AU MA-KA CNOSSIEN: Une nouvelle lecture en KN F 51 et ses consequences pour les tablettes linéaire B de Thèbes.” These articles helped me then and still now to remember that attaining δόξα ἀληθής ‘true opinion’ about ancient texts as complicated as many of those written in Linear B are usually takes time, patience and perseverance. Interpreting Linear B texts requires meticulous attention to the fine details of the inscriptions per se. We have to assemble the fullest data directly or indirectly relevant to the issues at hand. We have to survey what other scholars, past and present, have proposed about almost each and every word or ideogram. We have to develop and modify our own ideas as our understanding of past and current theories and the implications of the pertinent data dictate.

These are the principles that Yves Duhoux has perfected over a half century of tireless scholarship as a philologist, a linguist, an historian, and a humanist acutely sensitive to the human experience in the distant past and the present.

Many thanks, Yves, for who you are and what you have accomplished as a scholar and as a teacher of other scholars.

Tom Palaima

Armstrong Centennial Professor of Classics

Director, Program in Aegean Scripts and Prehistory

The University of Texas at Austin

Ruth Palmer on Yves Duhoux

I wish to thank Yves Duhoux for many things over the decades: his rigorous scholarship and the extraordinarily large range of topics he covered, his A Companion to Linear B Vols 1-3, generosity in sending his new publications, personal presence and not least the charming holiday drawings of home and cats that arrived regularly at the end of every year.

In my scholarship I have drawn most directly upon his work on landholding (Aspects du vocabulaire économique mycénien, 1976) and Linear A. His work illustrates in the best possible way the relationships between the words and the logograms in Linear B tablets. Analysis of patterns in the formats, numbers and signs for things on the tablets go only so far; the correct identification of the forms and meanings of the words unlocks the full potential of the information on the tablets.

The works I consult most frequently and give to my students are the volumes in the series A Companion to Linear B, and its predecessor Linear B, a 1984 Survey, edited by himself and Anna Morpurgo-Davies. Chapter 9, “Mycenaean Anthology” in Vol. 1 contains most of the tablets which are mentioned in two of the more recent popular handbooks in English: Davis, J. (ed) 2008, Sandy Pylos, and Shelmerdine C W. (ed) 2008, The Cambridge Companion to the Aegean Bronze Age. Duhoux’s chapter presents all the information needed for a novice to understand each tablet: physical form and condition, archaeological context, epigraphic hand, facsimile drawing, transcription, transliteration, translation and commentary. No other source does this. In Vol. 2, Chapter 11, ”Interpreting the Linear B tablets: some guidelines” sets necessary parameters for interpreting the tablets. It offers essential advice for beginners, notably to use the latest editions of the tablets, examine the contexts carefully and evaluate the interpretations critically.

But I learned the most about how to organize and illustrate examples when writing my chapter for Vol. 1: Ch. 2, “How to Begin?” For this task, I was fortunate enough to have the resources of the Burnam Classics Library at the University of Cincinnati. As editor, Yves gave constant feedback on the components of the chapter and we went through seven or eight drafts of the illustrations before coming up with the most informative formats. I am grateful for his patience with my contribution and look forward to the next volume of the Companion to Linear B.

Ruth Palmer

Associate Professor

Department of Classics and Religious Studies

Ohio University

Anna Panayotou-Triantaphyllopoulou on Yves Duhoux

In 1986, I met Yves Duhoux for the first time, at Pont-à-Mousson, Nancy, during the “Première rencontre internationale de dialectologie grecque”, organized by Cl. Brixhe et R. Hodot. Since then we have met in various conferences on Greek linguistics and Aegean or other substratum scripts, held in Europe or in the USA. He has always been actively participating in numerous international congresses. Yves has offered us not only new topics and original ideas and approaches, but his observations during discussions are always polite, helpful and to the point. As a person, I remember him as always friendly and unfailingly courteous towards the novices, the young participants in those meetings. During the agitated 4th International Colloquium on Ancient Greek Dialects held in Berlin in 2001, Yves was among those who managed to take control of the situation with calm, dignity and clear honesty and good faith. His actions then helped to ensure a future for this series of colloquia.

Since 1993, when I first organized my courses on the history of ancient Greek dialects at the University of Cyprus, Y. Duhoux’ book Introduction aux dialectes grecs anciens figures among the basic bibliography. Despite its age, this study is still a concise, well informed history of ancient Greek dialects, from Mycenaean times till the formation of the Koiné. For almost 30 years, my students have benefitted not only from this book but also from Yves’s numerous contributions on a wide range of topics, from Greek (especially Mycenaean Greek) to his numerous, fundamental contributions on epigraphy of pre-Greek scripts and languages.

From my own first articles onwards, I have profited enormously from Yves Duhoux’ inspiring “œuvre savante”. And more, much more than this, for more than 30 years I have been honored by his friendship, his benevolent attitude and his ever-ready generous help on occasions too numerous to list here.

Thank you, Yves, for your mind, your heart and your spirit.

Anna Panayotou-Triantaphyllopoulou,

Emeritus Professor of Linguistics,

University of Cyprus

Massimo Perna on Yves Duhoux

Ho avuto l’occasione di incontrare per la prima volta Yves Duhoux nel 1989 in occasione del colloquio di Liegi, Phoinikeia Grammata, il mio secondo convegno internazionale, dove presentavo una comunicazione sulla più antica tavoletta in cipro-minoico da Enkomi. Dopo la mia comunicazione, a tavola, Yves Duhoux si complimentò per la mia relazione e per me, che a quel momento ancora non ero laureato, quelle parole furono di grande incoraggiamento.

Negli anni successivi durante la preparazione della mia tesi di laurea, il suo contributo del 1989 sulla lineare A nel volume Problems in Decipherment, da lui edito assieme a John Bennet e Tom Palaima è stato il punto di partenza per la comprensione delle problematiche di questa scrittura minoica.

Analogamente, durante la preparazione del mio dottorato sulla fiscalità micenea il suo volume del 1976 Aspects du vocabulaire économique mycénien: Cadastre, artisanat, fiscalité è stato un importante riferimento per orientarmi nel dedalo dei termini del vocabolario economico miceneo.

Nella sua recente recensione del primo tomo del Corpus della scrittura sillabica cipriota edito da A. Karnava e da me ho molto apprezzato il garbo e la competenza del suo giudizio. Sono quindi molto lieto di pubblicare questo mio ricordo a testimonianza della mia stima.

Massimo Perna

Centro Internazionale per la Ricerca sulle Civiltà Egee “Pierre Carlier”

Oristano (Sardegna)

Vassilis Petrakis on Yves Duhoux

I have had the good fortune to meet Yves Duhoux on a few formal occasions. The first one was on 21 March 2015, on the first day of a Cambridge conference that focused on the relationship among Aegean (and Cypriot) writing systems. On its inauguration, he made the observation that this was the first day of the spring, an observation that everyone else in the room apparently missed, but the Bronze Age man would never do. During and between sessions, we had long talks over cups of coffee or tea. Yves was always kind and encouraging, giving generous advice and open to discuss a different viewpoint. Although this was our first meeting in person, Yves Duhoux was already a close acquaintance as the author and editor of works, including important monographs, that easily rank easily among the most valuable in our field.

His scholarship displays rare treasured gifts. He is hands-on, addresses problems clearly and attacks them directly. He is also extremely rigorous in his method. We are thankful for these two attributes of his work, because they form a formidable background to the third characteristic of Yves Duhoux’s work: his courageous choice of subjects, of topics demanding exactly the kind of methodological integrity, breadth of knowledge and meticulous attention to detail that he has made his signature modus operandi. Whatever the topic, Yves has never been superficial. Although he is not an archaeologist, he would have been an excellent field researcher: he never leaves any stone unturned.

His second monograph, published in 1977, focused on what Emmett Bennett once termed “the equivalent of the skull and crossbones on the bottle of poison” (“The 3 R’s of the Linear A and Linear B Writing Systems” Semiotica 122 [1998], 139-163, at p.139) and what Michel Lejeune, examiner of Yves’ dissertation at Louvain calls it in the very preface he wrote for this monograph “un engin dangereux”: the Phaistos Disk. This work proved him a sober, systematic scholar able to address a topic most would avoid, elegantly crafting an excellent monograph and helping the rehabilitation of this important inscription into Aegean epigraphy. Much later, he would return to this notorious inscription, to offer calm advice on “How not to decipher the Phaistos Disc” (American Journal of Archaeology 104:3 [2000], pp.597-600).

This has since been a recurring feature of his work. He picks up topics that appear unpromising, based on scanty evidence, even some that are dangerously seductive, topics that few -if any- of us would suggest for seminar papers or dissertations: Eteocretan, Linear A, Cypriote writing, non-Greek Aegean and Cypriot languages, scribal training, word-division, verb morphology, syntax and, perhaps most startlingly, the “beginnings of Greek science” approached through an analysis of elaborate arithmetic terminology employed by the Linear B ‘scribes’ (his article in Kadmos 52 [2013], pp.53-68) or a re-interpretation of the Keftiu of the ‘Islands of the Great Green’ in the Egyptian texts as residents in the Nile’s Delta (the subject of his 2003 book titled Des Minoens en Égypte? “Keftiou” et “les îles au milieu du Grand Vert”, coinciding with the same cautionary note raised on the very same year by the late Claude Vandersleyen in the Oxford Journal of Archaeology 22:2 [2003], pp.209-212). He offered sober and wise advice on method of interpretation in Mycenaean texts, and he did so in typically open manner -a mode we might begin to call ‘Duhouxian’- in his own contribution to the second volume of the Companion to Linear B that he co-edited with Anna Morpurgo Davies (2011). In this particular article he confesses: “I genuinely feel that in [a fresh] examination the LB records should be looked at as if we were the first to study them” (italics original). These words are honest, because the scholar who wrote them has done exactly that throughout his long and successful career.

Thank you Professor Duhoux, Yves, for being the scholar you are. May there be many more years of active participation at the helm of those events and works that shape the discipline which you have chosen to serve in such a uniquely creative way.

Vassilis Petrakis

National and Kapodistrian University of Athens

Rachele Pierini on Yves Duhoux

Yves Duhoux was the first Mycenologist I met in person. After my MA, I started proactively seeking advice on how to pursue a PhD in Mycenaean studies. I reached out to Europe-based Mycenologists whose work was closely aligned with the career path I chose to pursue, that is Mycenaean linguistics and philology. Duhoux replied very kindly to my message and invited me to spend a day in Leuven.

He welcomed me in his office and devoted his day to me. He started the conversation by sharing some of his own memories of when he was himself in my position and received advice from the scholar who would later become his mentor, the rightly legendary Michel Lejeune (one of the Mycenologists that I have always admired the most). Duhoux shared several anectoda and personal experiences. A very fond memory of our meeting is the moment in which Duhoux shared with me one the pieces of advice from Lejeune that Duhoux took to heart and has always followed: “You can’t be a Mycenaean linguist without being a philologist, and you can’t be a Mycenaean philologist without being a linguist. Duhoux’s eyes and voice were speaking volumes about how deeply he admired and respected his mentor and, also, how proud he was to share this with someone who was about to embark on the Linear B journey.